#Iobit smart defrag 6 install#

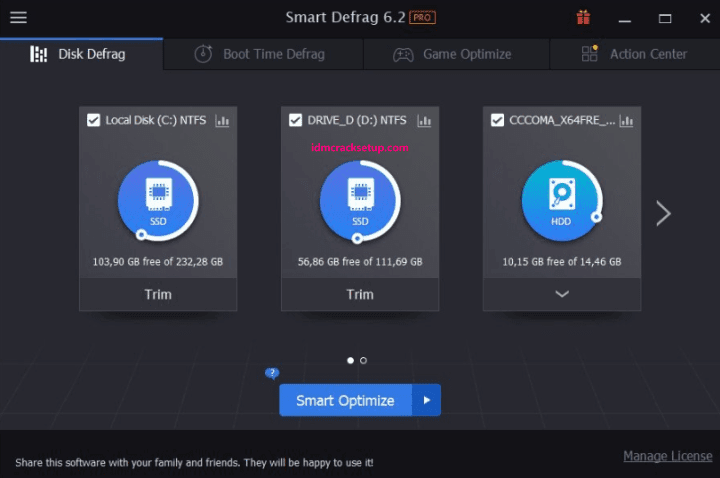

There’s a free version available with limited features as well.Download the program and install it on your computer. Here are a few features of Iobit Smart Defrag: It quickly defragments unmovable files on HDD for faster start up. Iobit Smart Defrag fixes this issue by configuring Boot Time Defrag feature. As PCs get older, they tend to take longer time to start up and launch application. Iobit Smart Defrag is a smart solution designed to enhance the performance of older PCs.

#Iobit smart defrag 6 Pc#

Iobit Smart Defrag enhances PC Booting Capabilities It enables users to select the game of their preference for defragging and work accordingly.

Another key feature it offers is “Game Optimize” in its Smart defrag engine. Iobit Smart Defrag results in faster game launching speed, quicker file copying & moving, quicker booting, etc. It does not corrupt any data in the process and is exceptionally user-friendly. Iobit Smart Defrag utilizes enhanced multi-threading defrag engine to increase the pace of fragmentation without compromising the disk performance. Iobit Smart Defrag 6 uses a new-gen defragmentation engine for the data-friendly division. It helps users fragment their hard disk for optimum performance and better storage capability.

#Iobit smart defrag 6 software#

Iobit Smart Defrag is one of the best utility software available in the market. Iobit Smart Defrag 6 Software Pricing, Features & Reviews What is Iobit Smart Defrag? Buy Now & Pay Later, Check offer on payment page.Please be aware that if the wrong GSTĭetails are given when placing an order, the order will be Match additionally, the GST authority will not grant input taxĬredits if the delivery address and GSTIN on the GST invoice areįrom different states. Rules must be followed in order to claim an input tax credit. Please be aware that the provisions of the GST Act and The registered place of business according to the GSTĪuthority's data in order to efficiently claim an input taxĬredit. Please choose the address that is listed as In any way responsible for the GST Invoice or any associated and the Seller are not responsible for anyįailure on the part of the user, including issues related to Invoice will not be entertained by or the Seller. Include the user's GSTIN and the name of the business entity Please be aware that the GST invoice must if an exchange offer is made concurrently with the

if the items come with Value Added Services such asĬomplete Mobile Protection or Assured Buyback. The following goods and services will not be eligible On the Platform's product detail page will be qualified Sellers and bearing the callout "GST Invoice Available"

Only specific items sold by participating Please be aware that not every product qualifies for a The User's specified Entity Name for the User's The GSTIN submitted by the User in connection with the Other things, have the following information printed on The purchase of all such products, which will, among The user will be sent a Tax Invoice ("GST invoice") for Through the Platform for business, advertising, resale, or Users are forbidden from using any of the products they buy However, all purchases made on the Platform must be for personal Products from merchants on the platform that meet their needs. Users who have registered businesses can buy

0 kommentar(er)

0 kommentar(er)